Niche Markets

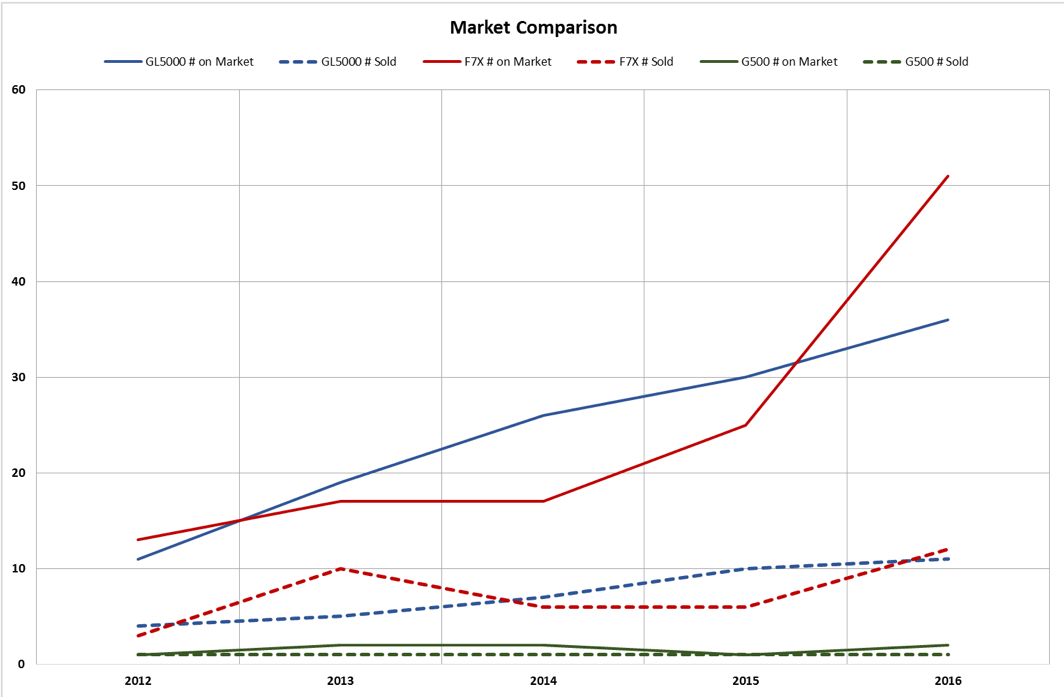

Of the aircraft in the ~5000 nm mission, 3-zone cabin category (legacy Gulfstream G500, Global 5000, Falcon 7X), YOY inventory is on the rise, transactions remain flat and values continue to decline.

When the 5000 and 500 entered service in 2002 and ’03 respectively, they were intended to fit a niche between the super mid-size and ultra-long range segments, while staying under the $40M price point. On the other hand, the 7X was designed to compete in the 6000-nm niche, however at a typical cruise of .85M the aircraft was more in line with the range of the G500 / 5000 (Note: Falcon 8X is well suited in the ultra-long-range segment). The Global 5000 was initially marketed as a step up from the Gulfstream G450 and Falcon 900EX, whereas the G500 was marketed as a step down from the G550 with major standard equipment for the 550 (HUD/EVS, etc.) being optioned on the G500. Both the G500 and Global 5000 were priced ~$8M less than their ‘big brothers’, whereas the 7X had an initial price point of $42M which was in line with the Global XRS / G550.

The G500 was certified using the GV (aka G550) type certificate (TC) and as a result entered service equipped with the Primus Epic PlaneView [LCD] cockpit. Conversely the Global 5000, using the legacy Global Express TC, was equipped with 6-Primus 2000 CRTs, which were not replaced until 2011 (s/n 9445, 2011 YOM), when Pro Line Fusion (LCD) became standard for the Global 5000/6000 (Note: Primus Elite LCD retrofit is available for early 5000s w/ CRTs). Similar to the G500, the 7X entered service (2007) with the EASy Primus Epic cockpit featuring 4-14” LCDs. HUD/EVS were options for all 3-model aircraft, as is high speed data, Satcom, etc. From a design perspective, the 7X excels using fly-by-wire technology (a first for business jets) and side stick controllers, vs the traditional yoke.

By way of illustration, over the last 3 years selling prices have dropped an average 44% for a 2006 G500, 34% for a 2010 7X and 24% for a 2009 Global 5000. All 3 models have 9-10% of their available fleet on the current market. The 7X and Global 5000 are showing 26 and 20 aircraft respectively, whereas the G500 shows only 1 as there were only 10 aircraft built from 2003-2009, similar to the Gulfstream G350 fleet of 11 aircraft or the Falcon 900C and 900DX, both with 24 aircraft in their respective fleets.

When we consider the accelerated market depreciation that’s occurring in all business jet markets, all the above-mentioned M/M’s are being impacted similarly. From a sales dollar perspective, a 2011 Global 5000 and 2011 Global 6000 are maintaining an $8M delta, a 2008 G500 vs a 2008 G550 is showing a $4M spread. Although there’s a ~$10M price differential between a new Falcon 7X and 8X, only time will tell how pre-owned aircraft will fare in the future.